Welcome to the site of messaging! If you are a Product Manager for a messaging tool or are just very much interested in mobile messaging, then you should read my master thesis about messaging (global user behaviour and new technologies in messaging apps).

Category Archives: Messaging Apps Valuation

The 6 Segments Model For Messaging Apps And Its User Long Tail

Please participate in this international survey: ‘What would be the ideal messenger for you?’. The findings (activitiy and preference rankings) will be shared with participants.

Where is currently the hightest growth potential in mobile messaging apps?

In all messaging app segments is still high growth evident. Beside the Top10 players, special interest messaging solutions which focus on end-to-end messaging encryption and privacy features are currently strongly gaining new users. Solutions like threema.com (secure) or franklychat.com (privacy) are examples for this newest market development.

Facebook Buys WhatsApp For US$ 19B – Paying A Premium For Taking Control Over Global Messaging And Future mCommerce

It is happening like the economics books stimpulate: After a cycle of (user) hypergrowth follows a cycle of acquisitions and consolidation. With this acquisition on 19th February 2014, Mark Zuckerberg ultimately made sure about 3 things: 1) there won’t be any new ‘Facebook’ from a competitor in the near future, 2) his empire will be a strong player in the increasingly growing global mCommerce and 3) his empire will still exist within the next 8 years. – Consider WhatsApp, a clear threat to Facebook, just needed 4.5 years to come to this point. Another 2 years and WhatsApp would have 1B users. When new technologies and platforms (mobile) evolve, things can happen disruptingly fast.

Continue readingWhat Different Cultures Do Most And Least in Mobile Messaging Apps

The following results are based on 250 survey participants from 4 cultures, answering each 40 questions about their mobile messaging app (MMA) behaviour from November 2013 to January 2014. The results can be seen as a hint to potential existing tendencies in the field of mobile messaging apps and should be verified by further research.

Continue reading

Messaging Apps 2013 in Review –

The Year of Growth Explosion and Leader Separation

In the past 6 months, WhatsApp and Line have been growing fastest – WhatsApp with 25M monthly active user per month (MAU), and LINE with 25M registered users per month. Read the messaging app essentials 2013/14 incl. the 6 segmentation models for messaging apps in below summary, which is partly the result of my messaging consumer research. More facts to follow soon.

Continue readingMessaging: WhatsApp flying off; New Feature Survey; Rise of Super Communicators

Plus: Read why WeChat is currently the most sophisticated and intimate mobile social network. And get to know the new breed of young digital Super Communicators.

Plus: Please participate in this international MBA thesis survey: ‘What would be the ideal messenger for you?’. The findings (activitiy and preference ranking) will be shared with respondents.

WhatsApp flying off; WeChat an LINE lonely followers

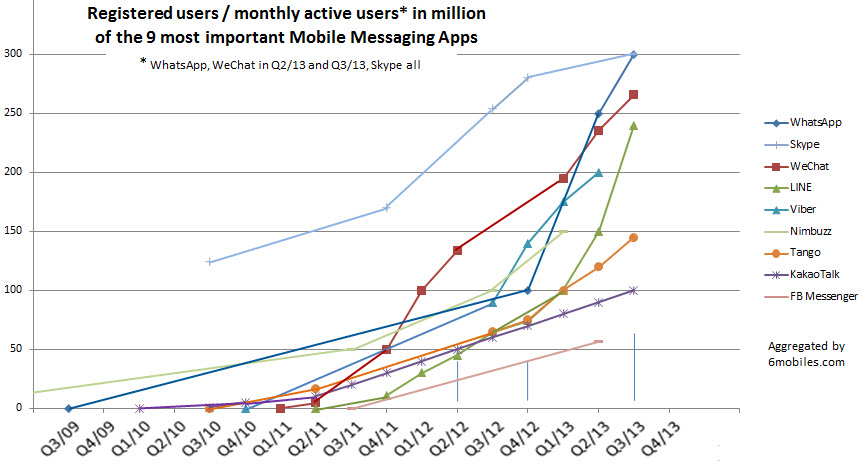

On 13th November and 25th November, WeChat resp. LINE have published their latest user numbers. WhatsApp has done that during the recent month, too. It’s a good moment to have a look at the newest comparison:

WhatsApp: 350M MAU until 22th Oct (added 25M MAU per month, in the recent months)

WeChat: 272M MAU until 30th Sep (added 12M MAU per month, in the recent months)

LINE: 300M registered users until 25th Nov (added 25M registered user per month, in the recent months)

See below the updated user base development:

The mathematical figures say that WhatsApp and LINE grow at same speed/quantities. But unfortunately LINE doesn’t report monthly active user figures. Therefore this comparison is not valid. WhatsApp is currently showing the highest growth rate in adding MAU. LINE is currently growing at nearly double speed of WeChat if assumed that 80% of LINE’s new registered users are also MAU.

These strong developments of WhatsApp and WeChat/LINE are a sign that these players will co-exist on one consumer’s mobile device because both value propositions satisfy different needs (most advanced messsaging communication interface [WhatsApp] vs. mobile social networks [WeChat/LINE]). Also see post from 17th September 2013.

Viber, Nimbuzz and Tango start to fall behind as they remain silent about their MAU figures. Kik shows good momentum as the most relevant messenger from North America in the youth segment.

WeChat most intimate

WeChat is currently the most sophisticated and intimate mobile social network for many reasons:

1) They were the first to introduce the feature people nearby (which does not exist in LINE) and the feature ‘shake-your-phone-to-find-people-who-look-for-new-contacts-too’. So the messenger is especially interesting for people who are outgoing and would like to meet like-minded people. Or if someone is new in a certain area this feature can help a lot with getting information about the place. [Nearby feature is also available on Tango or for younger people on InstaMessenger]

2) Once you have made friend with a WeChat user, you can see the time-line of this person, which can only be seen by the friends of the profile owner (A). Friends can comment on the posts (or on the profile) of (A) but these comments are only visible to the writer and (A). No other eyes! It’s a great environment to stay mobile, private and very close (verbally). It’s 1:1 communication. This is the counter-trend to postings in Facebook (1:n communication) where all is transparent to all friends (if alterable at all by special rules to be set up in the account).

3) It is more difficult in WeChat than in LINE or Kakao to enter into another person’s mobile social network environment. In WeChat most first concacts have to happen over a 40 characters greeting line. Whereas in LINE and Kakao people can paste in a high amount of greeting text to make the first contact. Therefore, connecting on WeChat is more challenging (more secure?) than in LINE and KakaoTalk, but that is probably also one of the main reasons why WeChat cannot show the same adoption speed like LINE. LINE has twice the international user base as WeChat, therefore LINE is more crowded with young people who are very open to connect internationally as they are also more likely to speak English (LINE user abroad Japan: 216M; WeChat users abroad China: 100M, both in Q3/2013). For this reason LINE has become more international than WeChat.

Still, by the facts of the home market situation, WeChat should be able to grow faster than LINE because WeChat still has huge potential in China with its more than 400M mobile internet consumers. WeChat rather spreads very strong along the immigration routes of Chinese into other countries.

Another growth slowdown factor is WeChat’s ‘dead’ communication interface without notifications of sent, delivered, read and online. Consumer research clearly shows that these indications are very important to messenger users. Read more about this in below post of 17th September.

The rise of digital Super Communicators

Messengers used in combination with Twitter have developed and inspired a new breed of young (13-25 yrs) digital Super Communicators who use virtuosically various communication channels with usually a large group of international friends and followers. Kik (and Instagram) is the most used exchange platform involved in these new connecting activities. These young Super Communicators live with the reality that they have to communication several times per day, otherwise they loose their top-of-mind-position with their followers. They become full-blown PR professionals with insights about all social tool mechanisms before 20.

A proverb of this group is: ‘When I close my Twitter on the laptop in the evening, I go to bed with my mobile and start Kik’. To some of them, this is their night entertainment: meeting new people, meeting hopefully friendly strangers.

These individuals, which are the innovators of a new soon-to-come mainstream, are also more open to the next evolution of messengers, which will connect people nearby, or connect strangers.

More analysis to follow soon.

Mobile Messaging: Who are the Winners? The User Base Development of the 9 Most Important Mobile Messaging Apps in the Last 4 Years

Read this post to see which mobile messaging app is the winner of current 2013 and who did especially well in Q3/13, and which messengers work best with telecoms. Furthermore, get to know WhatsApp’s comparative advantage: a ‘lively’ communciation interface.

In the daily novelties about new user numbers and new features of boasting mobile messaging apps, it is hard to keep the overview of how each of the mobile messaging apps (MMA) is really doing compared to the others. This summary of the 5-year-history of OTT MMA by 6mobiles.com provides an overview of how the user bases of the 9 most important MMA (by size of user group) have developed.

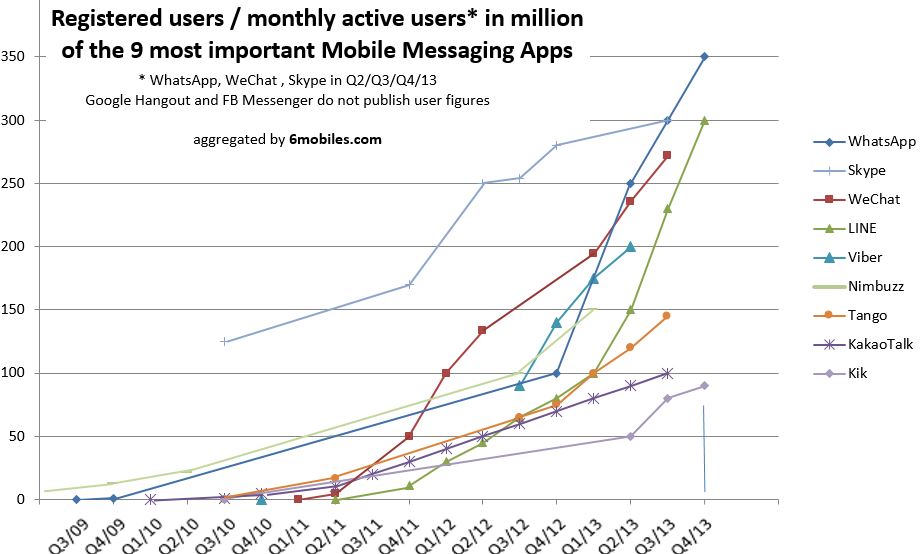

For the time from Q3/09 to Q1/13, this chart is based on registered users. In 2013, the first MMAs started to report monthly active user (MAU) numbers (WeChat from Q1/13, WhatsApp from Q2/13, Skype all figures in MAU, but desktop+mobile). The sources for this chart are MMA websites or trusted press articles.

Who is the winner of Q3/13?

LINE has added about 80 million registered users in the last 3 months (and about 165 million registered users over the last 12 months). This is a proof of their effective regional customized TV and print campaign. Whether these registered users will turn into MAU we will know once the company will disclose its MAU figures. However, LINE states that 80% of all registered users are MAU in July 2013, which would suggest that LINE has a higher user engagement than WeChat as this ratio was at 50% for WeChat in May 2013. LINE has big plans: it wants to become the first global Internet company from Japan/Asia. The company has already stated that it will make revenue of approx. US$100 million in Q3/13. This revenue is high compared to the revenue of WhatsApp which mainly comes from annual app subscription fees (and telecom collaborations). But putting the amount into relevance to WeChat’s 2nd quarter 2013 e-commerce revenue of US$ 359 million, the sum is decent.

Who is the winner of 2013?

WhatsApp added about 200 million MAU in less than the last 12 months (added about 60 million in the last 3 months). The specialty: WhatsApp does no ads, no marketing campaign, no games. This concludes that users are seeking easy-to-use, single-minded communication tools. But the strong user base increases of LINE and WeChat prove that users are also highly interested in more than a MMA only. And what results will Viber, WhatsApp’s most direct competitor, deliver soon? Viber stands in the shadow of the others as it has not published new user figures yet (which probably means they are falling behind) but, strangely, with messaging and voip calls capabilities, Viber even can do more for the user than WhatsApp. Therefore it would be very insightful to understand through consumer research what is WhatsApp’s superiority regarding product and (no) marketing. Read further down about the comparative advantage of WhatsApp’s ‘lively’ communication interface)

WeChat (China) or LINE (Japan) vs. WhatsApp (USA) or Viber (Cyprus)

WeChat and LINE go similar ways as mobile social network apps (MSNA) with official brand accounts (which need to be paid by brands), that can be added by users for information, interaction and benefit sharing reasons. Both of them are sustainable ad business models. It will be very interesting to see which one will win in Asia – and abroad. Whereas WhatsApp has a different positioning as highly functional tool focused on messaging only.

The mediocre result (see here) of KaokaoTalk’s campaign in Japan 18 months after Line’s Japanese launch is a hint to the possible scenario that two similar mobile social network apps (MSNA) will not coexistingly be downloaded as there is too less differentiation in the user benefit. Furthermore, a user mainly tends to update only one timeline and tool. WeChat definitely has its huge Chinese potential user base all over the world, whereas LINE, very recently, apparently has been able to create a higher coolness factor among European and American youth. The figures regarding global expansion success give a clear trend: LINE has about 180 million users (outside Japan), WeChat has 100 million users (outside China). The race has become sophisticated between the two Asian competitors, who both aim for the global leadership in MSNA rather than in MMA. This was recently best portrayed in the situation that WeChat – as first-mover – had a TV ad endorsement contract with Lionel Messi, but LINE just released official stickers of all players from FC Barcelona and Real Madrid. The Spanish football league is of high strategic relevance for the conquest of Europe and Latin America as well as for the assumed user messaging during the football world championship next year. So when the race will go into its next phase the battle about the users’ choice will be more fierce between WeChat and LINE than between the two and WhatsApp. But WhatsApp definitely has to develop a stage-2-plan of its value proposition. (Note: The figures in above graph are MAU for WeChat and registered user for LINE.)

First-movers and fast followers – but the race is just entering its most pulsating phase

The chart reveals that Nimbuzz was the first mover for MMA (Nimbuzz launched their first apps for Java and Symbian phones in May 2008, iPhone app followed in November 2008), followed by WhatsApp in July 2009, by KakaoTalk (6 months after WhatsApp), Tango, Viber, WeChat (1.5 years after WhatApp), LINE. So WhatsApp has an advantage of 2 years against LINE in collecting users. Nevertheless, the MMA industry also proves that – even with 2 years market launch disadvantage – an app can strongly catch up in terms of gaining new users by marketing campaigns, especially if the market leader is relying on word-of-mouth only to propel its solution.

It’s visible that the MMA big boom started in the second half of 2012, with WeChat as a forerunner of exorbitant user growth (due to the vast number of mobile users in China). In March 2012 WeChat was the first MMA to reach 100 million registered users, after only 14 months of existence (start record). Most of the MMA exhibit the same ramp-up speed in terms of user numbers. In their beginning phase the most performing MMA were WeChat, LINE, and Viber. The slowest ramp-up start revealed Nimbuzz, KakaoTalk (due to its initial limitation to South Korea) and FB messenger (probably due to the fact that they were the lastest among the top players to enter the MMA market; only Google was even later with their launch of Google+ Hangouts mobile app in May 2013, as a followup to Google Talk that was activated in 2005).

The chart also exhibits that 100 million users are the threshold for critical mass. After this user group value growth has been exponential for WhatsApp, LINE, and Viber, driven by enlarged network effect and global media coverage.

The race for global leadership in MMA will be decided between WhatsApp, WeChat, LINE, (and Viber?). Tough Skype first needs to show new momentum to be counted in. In October 2012 Skype CEO Tony Bates announced that Skype would target 1 billion users. Seeing Skype’s recently growth flattening in the graph, it seems like the MMA have put a spoke into Skype’s wheel.

Collaborations with telecom companies

WhatsApp’s strategy to focus on messaging app features only and to stick with a clear value proposition makes them a pole-position partner for service and data bundles with telecom companies; to be contrary to the mobile social network apps like WeChat and LINE. WhatsApp is currently very active with telecom partnerships in emerging regions like Africa and Asia. Nevertheless, there will also come the time for mobile social network apps (MSNA) sooner or later, once they have proven sustainable and active customer bases as well as the development of MSNA is better understood by marketing experts. It must be in the interest of telecom companies to cooperate with MSNA because their features generate much more data volume than messaging only, therefore the data rateplan or flatrate revenue for telecom companies would be higher with such products. A recent poll with 40 mobile carriers (conducted by moiblesquare) found that 36% of the polled telcos said they are going to partner with OTT providers this year, up from 32% in 2012.

So what is the comparative advantage of WhatsApp?

Lively vs. dead instant messenger interface

A test of all the big MMA tools by the author showed that WhatsApp has the most ‘responding’ communication interface. This works on three parameters:

1) It shows when a person was last time in the app or is online in the app. WhatsApp indicates ‘online’ only if the user is really in the app with the precision of seconds, and it does not show ‘online’ if the app is just running in the background (like Viber and FB Messenger do, which is not a timely indicator of actual user presence in the app).

2) Delivery reports belong to the standard meanwhile. While two ticks do only mean the message has been delivery to the server of the recipient. But if WhatsApp is running in the background it would push a notification on the topscreen of the mobile in that case.

3) It shows when people are ‘typing’.

Internal qualitative study (to be released in November) concludes that these three facts are very strong communication enabler, and they are only done by WhatsApp in the most accurate and proper manner, even to the extend that the timestamp ‘last seen …’ can be disabled/enable by users individually within seconds and not just once a day like in Viber. Interesting is that neither WeChat nor LINE support this helpful features. For WeChat it could be in dissonance with finding new friends nearby (location-based information), as user want to keep this sensitive information to their friends only.

Interesting issues that 6mobiles.com will cover soon:

Why has Viber lost against WhatsApp in terms of user numbers?

Why could KakaoTalk not win much in Japan after LINE?

KakaoTalk launch in partnership with Yahoo and TV campaign in December 2012 in Japan, 18 months after the launch of LINE in Japan. But competition could not be put upside down: In September 2013, KakaoTalk has about 15 million registered users in Japan whereas LINE has 46 million registered users in Japan, where smartphone population lays currently at 80 million. This maybe a hint to the point that two similar apps would not be able to win many users from each other nor that market shares can be changed dramatically.

How did WeChat their growth marketing in China in 2011/12?

How could WeChat generate a ecommerce revenue of US$359 in Q1/13?

How can marketers use the new mobile social networks?

Follow me on Twitter or link with me on Linkedin. Please participate in my global survey.

Dossier WhatsApp and the Competitive Landscape of Mobile Messaging Apps: Which strategy is right?

An interesting figure has come up in the ‘religious war’ between messaging-only-strategy (WhatsApp) and messaging-plus-VAS-strategy (WeChat, LINE) to create monetary value for the mobile messaging app companies: Tech-blog The next web has recently stated that WeChat had in May 2013 more than 400 million users but only 195 million monthly active users. This means that only 50% of the people who download WeChat messaging app also use it once or more per month afterwards, which again means that 50% of the downloaders would not use the app or use it less then once a month. This is are a rather clear failure statement about the front-end success (fast increase of users) of the aggressive marketing campaigns which WeChat (and LINE) currently are executing.

On the contrary, this usage figure is not known from WhatsApp, but e.g. with a similar calculation with Germany the usage rate is at 75%. WhatsApp was a paid-for app until June 2013 in AppStore, therefore it can be assumed that the usage rate is higher in a paid app than in a free app. To be fair, it should also be mentioned that Skype had in August 2009 560 million registered users, but only 124 million monthly active users, which is a monthly usage rate of even only 22%. But this benchmark first of all proves that – with mobile adoption – the usage rate of instant messaging tools has strongly increase.

Another symbolic decade change is happening: WhatsApp was on its way to passing Microsoft in terms of search popularity according to Google Trends at the beginning of September 2013. The trend was just broken by Microsoft’s acquisition of Nokia’s mobile handset business. But the trend also shows that it is likely that WhatsApp will pass Skype in Q1/14. These are the signs of disruption by mobile solutions. In below Google Trend chart is also visible that WhatsApp is undisputed mobile messenger leader in the western world. Strong competition comes from WeChat (China) and LINE (Japan), both are not or only partly reflected in their home market by Google Trends.

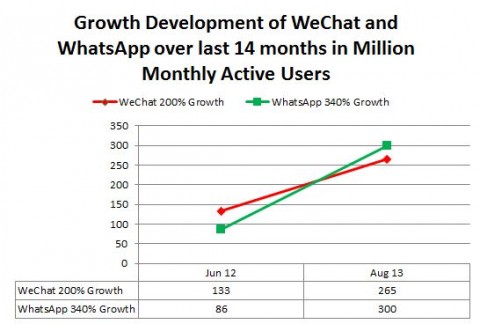

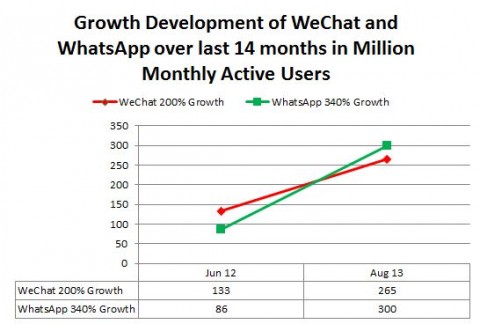

6th August 2013: WhatsApp has told AllThingsD it has 300 million monthly active users now. With an astonishing growth rate of 340% over the last 14 months (June 2012 – August 2013). This makes WhatsApp the most popular mobile messaging app outside China in the World. Only QQ NN mobile (from China) has more mobile MAU (478m MAU).

Internal calculations lead to about 90 million monthly users from Google Play (30%) (resulting from 100 million Android downloads by July 2013 and an assumed usage rate of 90%), 195 million monthly users from App Store (65%), and 15 million monthly users from other platforms like Windows and BlackBerry (5%).

Sources: WeChat Jun 12 (Tencent); WeChat Aug 13 (Tencent plus 30m MAU overseas from

The next web); WhatsApp Jun 2013 (Futurehandling.com 100m MAU ./. 14m MAU for 4 months,

assumption 6mobiles.com); Whatsapp August 2013 (AllthingD).

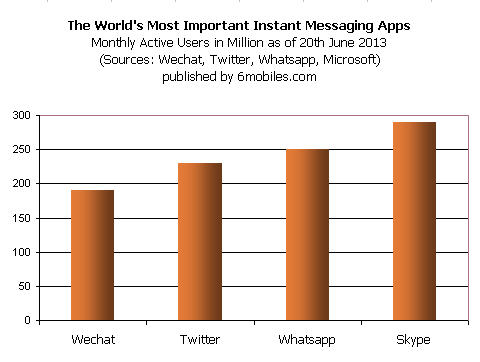

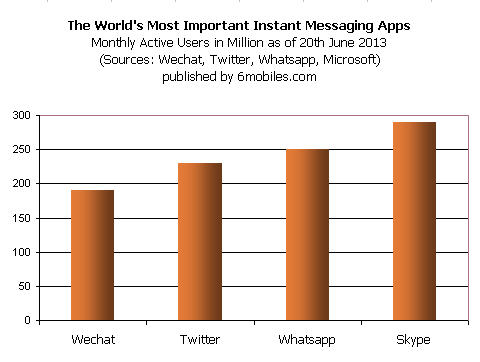

20th June 2013: WhatsApp has told The Wall Street Journal it has more than 250 million monthly active users.

20th June 2013: WhatsApp has told The Wall Street Journal it has more than 250 million monthly active users.

Most efficient

The four-year-old company WhatsApp currently employes fewer than 50 engineers, giving this disruptive company the highest ratio of active users per long-term employee today of any active tech company (6m Users per long-term employee).

User Growth

The development of WhatsApp started in February 2009, the app was eventually launched in July 2009. By end of 2009 the app had reached 1 million users. In October 2012, WhatsApp was at 100 million monthly active users. That was the first stage of early hypergrowth.

The time from October 2012 to August 2013 represents a second-stage growth period with still explosive growth of 200% within 10 months. This explosive growth was also fueled by 1) the boom effect on app distribution platforms in 2013, where the monthly app download rate in general doubled from 2012 to 2013, and by 2) the growing global smartphone penetration rate. More stats on users.

Strategy and Marketing

WhatsApp has a crystal-clear utilitarian strategy on messaging service above all, without ads or games and less emoji, provided on all possible mobile platforms (no desktop version) and in as many as possible languages, in order to guarantee optimal user experience.

WhatsApp does not advertise itself, their success is due to word of mouth. “You trust a friend more than any other source, right?” asks Brian Acton, co-founder of WhatsApp. On 12th August 2013, Kate Perry’s new music video ‘Roar’ was released; the clip is almost entirely told by WhatsApp messages. WhatsApp management says it has no endorsement deal with Kate Perry. The inspiring music video will support the global adoption of WhatsApp.

This no-marketing-strategy is in strong contrast to the strategies of WhatsApp competitors Wechat and Line. Wechat has a broad advertising campaign with Lionel Messi (Spain, Europe and South America). The ad would be aired across 15 nations soon. LINE works with special TV ads for each national market. The TV ads promise ‘Life is more fun with LINE’.

Pricing and Revenue

In the App Store, WhatsApp changed various times its pricing strategy. It started as free app in some national App stores (eg. Switzerland) and in other national app stores as paid app (eg. in the UK the app costed GBP 0.69 since December 2009). Since March 2013, the app costed $0.99 one-time fee in the App Store in all/most countries. On 16th July 2013 – only 4 months after the new pricing – WhatsApp changed the price to ‘free for the first year, but charges $0.99 per year after the first year’. This is the pricing model which WhatsApp used in Google Play ever since 2009.

In Google Play, WhatsApp only used one pricing model since its start in 2009. The app is free for the first year, but charges $0.99 per year after the first year.

The recent pricing decisions will create an annual revenue for WhatsApp in 2013 of approx. $100m from App Store and approx. $50m from Google Play. This pricing decision shows that WhatsApp wants to build up substantial long-term revenue.

The pricing itself is subtle: first the friendly offer, a consumer can use the app for free for one year which facilitates downloads of the app strongly, then after 1 year, when nobody wants to miss the app anymore, the pay scheme triggers in (as opt-in), but the annual USD 0.99 fee is low. Most of the WhatsApp users will never make any considerations about that.

Features updates for WhatsApp

On 8th August 2013, WhatsApp introduced voice messaging (walkie-talkie) to its solution, a reduced-to-the-max one tap functionality. As long as WhatsApp is not enabled for VOIP, this solution can help to facilitate the texting exchange in languages that are less simple to type (eg. Cyrillic).

On 29th Agust 2013, WhatsApp provided an APK download for the WhatsApp version 2.11.49, including some simple video editing tools. No pro tools, but it will allow users to splice and cut different videos to a certain length without having to open up a new app.

Competitors

In the new field of mobile messaging apps, Whatsapp has various rivals. The strongest competitors are Chinese originated ‘WeChat’ (with approx. 235 million MAU in August 2013, with approx. 40% (100 million MAU) of its users outside China).

WeChat (launched January 2011) users:

31th May 2011: 4-5 million registered users

31th December 2011: 50 million registered users

31th March 2012: 100 million registered users

30th June 2012: 133.4 million monthly active users

30th June 2013: 235.8 million monthly active users (70 million users outside China)

16th August 2013: 100 million users outside China

LINE (launched June 2011) users:

July 2013: 200 million registered users

14th September 2013: 240 milion registered users (stated by Dr. Jeanie Han at BeGlobal South Korea conference)

Further mobile messaging app competitors are:

Cyprus-based ‘Viber’ (approx. 220 million registered users in August 2013),

Nimbuzz (Netherland orginated, acting from India nowadays)

KakaoTalk (South Korea),

Tango (USA)

Facebook Messenger (USA)

Kik (Canada)

There is another circle of competitors: the instant messaging tools that started originally as desktop tool, but have also gained many users for their mobile app version:

QQ NN mobile (China): 478 million monthly active users

Skype with approximative 300 million monthly active users (mobile & desktop) in August 2013, but still with a high percentage of desktop only clients.

Volume of Messages

In June 2013: WhatsApp users sent 8b messages and received 12b messages (some messages go to several recipients).

In August 2013: WhatsApp users sent 11b messages and received 20b messages.

Average for June 2013: Based on 9bn – 10bn sent messages per day and about 250m active users (June 2013), in average, every active user sends about 40 messages per day.

Average for August 2013: Every active user sends about 36 messages per day.

Dossier WhatsApp and the Competitive Landscape of Mobile Messaging Apps: Which strategy is right?

Updated on 1st September 2013

Update 31st August 2013: An interesting figure has come up in the ‘religious war’ between messaging-only-strategy (WhatsApp) and messaging-plus-VAS-strategy (WeChat, LINE) to create monetary value for the mobile messaging app companies: Tech-blog The next web has recently stated that WeChat had in May 2013 more than 400 million users but only 195 million monthly active users. This means that only 50% of the people who download WeChat messaging app also use it once or more per month afterwards, which again means that 50% of the downloaders would not use the app. This is are a rather clear failure statement about the front-end success (fast increase of users) of the aggressive marketing campaigns which WeChat (and LINE) currently are executing. On the contrary, this usage figure is not known from WhatsApp, but e.g. with a similar calculation with Germany the usage rate is at 75%.

Another symbolic decade change is happening: Whatsapp is just passing Microsoft, and Skype soon, too, in search popularity according to Google Trends. These are the signs of disruption by mobile solutions. In below Google Trend chart is also visible that WhatsApp is undisputed mobile messenger leader in the western world. Strong competition comes from WeChat (China) and LINE (Japan), both are not or only partly reflected in their homemarket by Google Trends.

6th August 2013: WhatsApp has told AllThingsD it has 300 million monthly active users now. With an astonishing growth rate of 340% over the last 14 months (June 2012 – August 2013). This makes WhatsApp the most popular mobile messaging app outside China in the World. Only QQ NN mobile has more mobile MAU (478m MAU).

Internal calculations lead to about 90 million monthly users from Google Play (30%) (resulting from 100 million Android downloads by July 2013 and an assumed usage rate of 90%), 195 million monthly users from App Store (65%), and 15 million monthly users from other platforms like Windows and BlackBerry (5%).

Sources: WeChat Jun 12 (Tencent); WeChat Aug 13 (Tencent plus 30m MAU overseas from

The next web); WhatsApp Jun 2013 (Futurehandling.com 100m MAU ./. 14m MAU for 4 months,

assumption 6mobiles.com); Whatsapp August 2013 (AllthingD).

20th June 2013: WhatsApp has told The Wall Street Journal it has more than 250 million monthly active users.

20th June 2013: WhatsApp has told The Wall Street Journal it has more than 250 million monthly active users.

Most efficient

The four-year-old company WhatsApp currently employes fewer than 50 engineers, giving this disruptive company the highest ratio of active users per long-term employee today of any active tech company (6m Users per long-term employee).

User Growth

The development of WhatsApp started in February 2009, the app was eventually launched in July 2009. By end of 2009 the app had reached 1 million users. In October 2012, WhatsApp was at 100 million monthly active users. That was the first stage of early hypergrowth.

The time from October 2012 to August 2013 represents a second-stage growth period with still explosive growth of 200% within 10 months. This explosive growth was also fueled by 1) the boom effect on app distribution platforms in 2013, where the monthly app download rate in general doubled from 2012 to 2013, and by 2) the growing global smartphone penetration rate. More stats on users.

Strategy and Marketing

WhatsApp has a crystal-clear utilitarian strategy on messaging service above all, without ads or games and less emoji, provided on all possible mobile platforms (no desktop version) and in as many as possible languages, in order to guarantee optimal user experience.

WhatsApp does not advertise itself, their success is due to word of mouth. “You trust a friend more than any other source, right?” asks Brian Acton, co-founder of WhatsApp. On 12th August 2013, Kate Perry’s new music video ‘Roar’ was released; the clip is almost entirely told by WhatsApp messages. WhatsApp management says it has no endorsement deal with Kate Perry. The inspiring music video will support the global adoption of WhatsApp.

This no-marketing-strategy is in strong contrast to the strategies of WhatsApp competitors Wechat and Line. Wechat has a broad advertising campaign with Lionel Messi (Spain, Europe and South America). The ad would be aired across 15 nations soon. LINE works with special TV ads for each national market. The TV ads promise ‘Life is more fun with LINE’.

Pricing and Revenue

In the App Store, WhatsApp changed various times its pricing strategy. It started as free app in some national App stores (eg. Switzerland) and in other national app stores as paid app (eg. in the UK the app costed GBP 0.69 since December 2009). Since March 2013, the app costed $0.99 one-time fee in the App Store in all/most countries. On 16th July 2013 – only 4 months after the new pricing – WhatsApp changed the price to ‘free for the first year, but charges $0.99 per year after the first year’. This is the pricing model which WhatsApp used in Google Play ever since 2009.

In Google Play, WhatsApp only used one pricing model since its start in 2009. The app is free for the first year, but charges $0.99 per year after the first year.

The recent pricing decisions will create an annual revenue for WhatsApp in 2013 of approx. $100m from App Store and approx. $50m from Google Play. This pricing decision shows that WhatsApp wants to build up substantial long-term revenue.

The pricing itself is subtle: first the friendly offer, a consumer can use the app for free for one year which facilitates downloads of the app strongly, then after 1 year, when nobody wants to miss the app anymore, the pay scheme triggers in (as opt-in), but the annual USD 0.99 fee is low. Most of the WhatsApp users will never make any considerations about that.

Features updates for WhatsApp

On 8th August 2013, WhatsApp introduced voice messaging (walkie-talkie) to its solution, a reduced-to-the-max one tap functionality. As long as WhatsApp is not enabled for VOIP, this solution can help to facilitate the texting exchange in languages that are less simple to type (eg. Cyrillic).

On 29th Agust 2013, WhatsApp provided an APK download for the WhatsApp version 2.11.49, including some simple video editing tools. No pro tools, but it will allow users to splice and cut different videos to a certain length without having to open up a new app.

Competitors

In the new field of mobile messaging apps, Whatsapp has various rivals. The strongest competitors are Chinese originated ‘WeChat’ (with approx. 235 million MAU in August 2013, with approx. 40% (100 million MAU) of its users outside China).

WeChat (launched January 2011) users:

31th May 2011: 4-5 million users

31th December 2011: 50 million users

31th March 2012: 100 million users

30th June 2012: 133.4 million monthly active users

30th June 2013: 235.8 million monthly active users (70 million users outside China)

16th August 2013: 100 million users outside China

LINE (launched June 2011) users:

Further mobile messaging app competitors are:

Cyprus-based ‘Viber’ (approx. 220 million registered users in August 2013),

Japanese ‘LINE’ (200 million registered users in July 2013),

KakaoTalk (South Corea),

Hike (India),

Kik and

Facebook Messenger.

There is another circle of competitors: the instant messaging tools that started originally as desktop tool, but have also gained many users for their mobile app version:

QQ NN mobile (China): 478 million monthly active users

Skype with approximative 300 million MAU (mobile & desktop) in August 2013, but still with a high percentage of desktop only clients.

Volume of Messages

In June 2013: WhatsApp users sent 8b messages and received 12b messages (some messages go to several recipients).

In August 2013: WhatsApp users sent 11b messages and received 20b messages.

Average for June 2013: Based on 9bn – 10bn sent messages per day and about 250m active users (June 2013), in average, every active user sends about 40 messages per day.

Average for August 2013: Every active user sends about 36 messages per day.

Dossier Swisscom iO Messenger: Swisscom and other Telcos Start to Take On The Battle against WhatsApp: 11% of Smartphone Users in Switzerland have iO Messenger App in August 2013

Update, 25th August 2013

Initial post from 25th June 2013: Swiss telco Swisscom has just launched the independently developed free messenger and VOIP app ‘iO’ that competes with WhatsApp. After SK Telecom, KT and LG Uplus (South Korea, December 2012) and StarHub and SingTel (Singapore, February 2013), Swisscom is another innovative telco that tries to win back the customers that it has lost to WhatsApp with an own tool.

Update 20th August 2013: The newest move on this battlefield: Chinese operator China Telecom unveiled its mobile IM product in collaboration with Internet firm NetEase yesterday, called Yixin, in a move that literally declared war on reigning OTT messaging service WeChat.

The whole story of iO Messenger’s development by an internal Swisscom innovation team and the American creative company Moving Brands can be read here.

In comparison to WhatApp, the free iO Messenger app can also be used to make VOIP phone calls. Swisscom even additionally sells a Swiss flatrate of CHF 15 / USD 15 (to call all subscriber in Switzerland who are not subscriber to iO Messenger) as well as an European flatrate for CHF 25. But on 30th August Swisscom confirmed that it has not yet launched the paid flatrates because the quality of iO messenger service is not stable enough yet, 2 months after the product’s launch. The flatrates are planned for September 2013.

On 16th September, the first app update was released, 2.5 months after the start of the app. Among the updates was that pure voice-over-IP calls are encrpyted.

An advantage for the customers is that the messaging data is stored locally, within Switzerland. The iO messages are SSL encrypted – opposite to WhatsApp that only uses an MD5 hash of the phone’s IMEI number in reverse format.

Enabling feature

Another difference to WhatsApp, iO does not require the user to download the entire address book on a central server. But downloading the address book on a central server is what makes WhatApp so simple to users and it helps enormously in growing user penetration because this enables Whatsapp to show users immediately who of their friends are using WhatsApp, too. iO Messenger can’t do this feature; in iO each contact/chat request is handled individually to see whether the addressed person also has iO installed.

Image

The iO messenger app saw a image damage when newspapers disclosed that Swisscom sends anonymized user data for analytics to USA. This fact was for many iO starters in clear contrast to the earlier stated Swissness and security strategy by Swisscom, which again led within this user group to less activity on the app.

Strategic Options

Swisscom announced that the group chat feature will follow soon. This is the start of new unified messaging platforms. Swisscom could also act with an MVNO offer over iO Messenger. Sure that several further rateplan offers will be launched through the iO Messenger app, but adoption will take time.The former telco monopolist in Switzerland writes in the analyst report Q2/13: ‘New tariff systems will make Swisscom invulnerable against OTT threats’. Geofencing and location-based services will sooner or later be a competitive advantage of regional messaging tool providers. When will the telcos add a virtual fixnet number for these mobile platforms?

Download rate of iO Messenger

25th June 2013: 50’000 downloads

26th June 2013: 111’000 downloads

9th July 2013: 250’000 downloads

7th August 2013: 320’000 downloads

31st August 2013: 365’000 downloads

7th November 2013: 400’000 downloads

31st December 2013: 450’000 downloads

Makes a daily download rate of 16’660 in the first 15 days of existence, with a slowdown to 1’650 downloads per day in the following month.

8% of smartphone owners in Switzerland have installed Swisscom iO

With about 3,6m smartphones (and 6,3m feature phones) in Switzerland (February 2013), it can be estimated that about 8% of smartphone owners in Switzerland have already downloaded the iO Messenger app (assuming that 95% of the downloads happened by smartphone users in Switzerland).

There are no official/public figures regarding WhatsApp penetration within smartphone users in Switzerland, but it can be assumed that the WhatsApp penetration rate is as high as it is in Germany (91% in iPhone user). Especially if one considers that Switzerland has with more than 50% one of the highest iPhone penetration rates globally within smartphone sales. Under this constallation, it is clear that it will take a long time until iO Messenger could be a real competitor to WhatsApp in Switzerland. However, Swisscom has good possibilities and the funds to play the local hero with new (regional) features in mobile messaging.

Conclusion on 9th August 2013

The io Messenger app had a good start in terms of numbers of downloads, but most people don’t have much of a clue what to do with it when about 80% of their friends already use WhatsApp for mobile messaging. But this is only the first step of a new telco tool. Above all: Swisscom has made a very innovative statement to Swiss customers who have, in general, a very high affinity to innovation and quality.

Even though Ovum, an international telco strategy consultancy, urges telcos to collaborate for messaging interoperability in the combat of OTT providers, and to use messaging standard JOYN (which has been initiated and promoted by GSMA), Swisscom has decided to develop its own messaging tool. The reasons may be in slow progress in international decisions and collaboration, the wish to make independent decisions, national image emphasis, and low graphical adaptability of the industry solution. Companies like Vodafone, Deutsche Telekom, Movistar, Orange, MetroPCS already use the industry solution JOYN. JOYN also struggles with popularity within the GSMA members as many MNOs (especially in emerging markets) have started to co-operate with WhatsApp in creating new rateplans together.

Excursus: How to calculate the smartphone penetration?

There are two different approaches to calculate the smartphone penetration of a country:

1) Smartphone users per capita,

2) Smartphone users per mobile subscriber (which is also the official measure by UTI and here)

June 2013:

Smartphone users per capita: Switzerland has a population of 8.0m, incl. children; 3,7m smartphones; approx. 45-46% smartphone penetration per capita.

Google IPSOS survey study stated in May 2012 that smartphone penetration per capita is at 43%.

Note: The figure 3,6m/3,7m smartphones in Switzerland is based on a survey and not on actual telecoms device sales figures.

Smartphone users per mobile subscriber: 10.106m mobile subscribers as of 30th Jue 2013 in Switzerland (pre+postpaid of Swisscom, Sunrise, Orange); 3,7m smartphones; smartphone penetration approx. 36-37%.