In the past 6 months, WhatsApp and Line have been growing fastest – WhatsApp with 25M monthly active user per month (MAU), and LINE with 25M registered users per month. Read the messaging app essentials 2013/14 incl. the 6 segmentation models for messaging apps in below summary, which is partly the result of my messaging consumer research. More facts to follow soon.

Update 21st January 2014: WhatsApp has 430M MAU. Added 30M MAU within a month, and now sees 50 billion messages sent and received daily. More than doubled the number of messages processed within 6 months.

Please participate in this international MBA thesis survey: ‘What would be the ideal messenger for you?’. The findings (activitiy and preference ranking) will be shared with respondents. Return to this website within the next two months as all survey results will be published here.

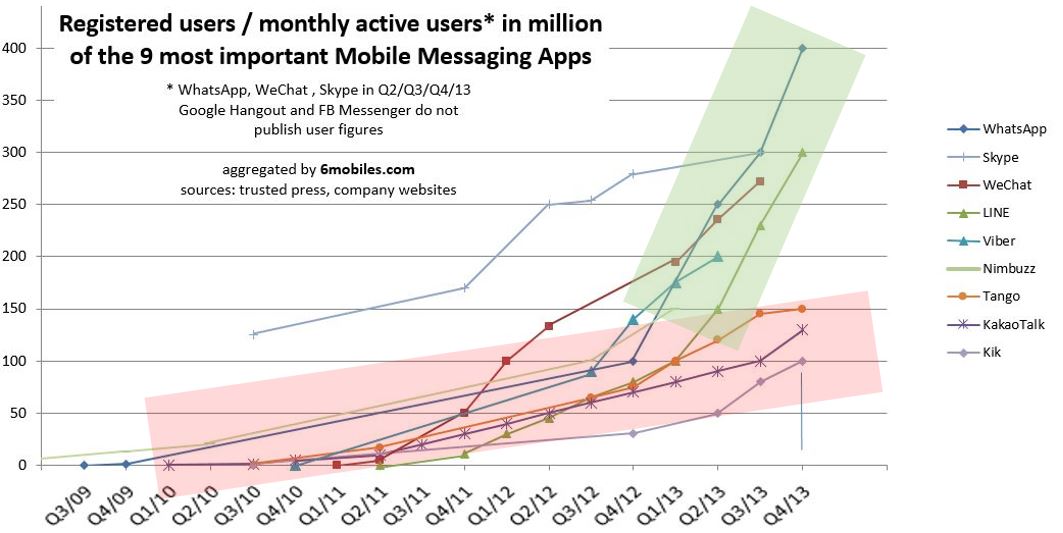

In November and December 2013, the three biggest mobile messaging apps have published their user figures – a good moment to have a look at the comparison:

WhatsApp: 400M MAU until 19th Dec (added 25M MAU per month, in the recent months)

WeChat: 272M MAU until 30th Sep (added 12M MAU per month, in the recent months)

LINE: 300M registered users until 25th Nov (added 25M registered user per month, in the recent months)

Below [infographic] shows what happend: until the end of 2012 almost all top10 messaging apps added users in the same quantiy but in 2013 WhatsApp, LINE and WeChat were able to increase the former user growth rate by up to 12 times (example of Whatsapp; user growth in 2012 approx. 25M; user growth in 2013 300M).

The mathematical figures say that WhatsApp and LINE grow at same speed/quantities. But unfortunately LINE doesn’t report monthly active user figures. Therefore this comparison is not valid. WhatsApp is currently showing the highest growth rate in adding MAU. LINE is currently growing at nearly double speed of WeChat if assumed that 80% of LINE’s new registered users are also MAU.

These strong developments of WhatsApp and WeChat/LINE are a sign that these players will co-exist on one consumer’s mobile device because both value propositions satisfy different needs (most advanced messsaging communication interface [WhatsApp] vs. mobile social networks [WeChat/LINE]). Also see post from 17th September 2013.

The following messaging app essentials summary 2013/14 is partly the result of market analysis and partly the results of my survey research with 220 messaging consumers:

The winners of 2013: WhatsApp, Line, WeChat

The middle field of 2013 that has lost touch with the top group: Viber (Update: 100M MAU or 280M reg user, sold to Rakuten on 13th Feb 2014), Tango, Nimbuzz

The climbers of 2013: Kik, Snapchat, FB Messenger

The messaging app of 2013 with best mobile commerce integration: WeChat (best), LINE, Kakaotalk, Tango

The steady-but-highly-progressive worker of 2013: Kakaotalk

The big-potential-but-unknown-outcome player of 2013: Skype (will it succeed to transit into the mobile age? With Microsoft it should be possible)

The most ingrateged messaging solution of 2013: Google+ Hangouts

The most relevant consumer expectation for 2014:

messaging security/privacy, end-to-end messaging encryption (Update: fueled by NSA affair and Facebook’s acquisition of WhatsApp; chatfrankly.com, threema.com a.o.);

delivery speed (benchmark WhatsApp; telegram.org);

messaging creativity (benchmark Snapchat and Kik/HTML5 integration);

messaging integration (Uni messenger a.o.)

Hot topic 2014: enterprise mobility messaging, public messaging, location based messaging, public group messaging

The true delighters (Kano model) of mobile messaging apps in 2013/2014: Timestamp for ‘online’ (benchmark WhatsApp) and notifications for ‘sent’, ‘delivered’, ‘read’ and ‘typing’ (meanwhile an industry standard; only Wechat does not adopt to this standard among the big players, and keeps thereby the most privacy-respecting interface, but thereby also missed the chance to use these features as strong communication ingniters)

The six mobile messaging app segmentation models:

1) general segment model (then focusing on a certain part of the messaging value chain like WhatsApp with messaging delivery);

2) youth/creativity segment model (e.g. Snapchat, Kik, Line);

3) ethnical segment model (e.g. WeChat or local hero MMA);

4) special interest model (e.g. focus on end-to-end messaging encryption like threema.com or on privacy like franklychat.com)

5) feature phone segment model (e.g. Saya.im, mxit.com);

6) customer/mCommerce segment model (e.g. Viber for Rakuten, Laiwang Messenger for Alibaba or Yixin for China Telecom).

Research has shown that strongest differentiation can be reached in youth segment and general segment (with focusing). Growing market interst in security/privacy focused messaging app.

Surprising is that key players like Viber and Tango apparently stagnate in user figures. What did they wrong? Viber has messaging and VoIP call features, and Tango turned to a mobile social network mid-year 2013 and has video VoIP call feature. All of these would be strong pros for growth.

More mobile messaging analysis data to come within the next two months.