Plus: Read why WeChat is currently the most sophisticated and intimate mobile social network. And get to know the new breed of young digital Super Communicators.

Plus: Please participate in this international MBA thesis survey: ‘What would be the ideal messenger for you?’. The findings (activitiy and preference ranking) will be shared with respondents.

WhatsApp flying off; WeChat an LINE lonely followers

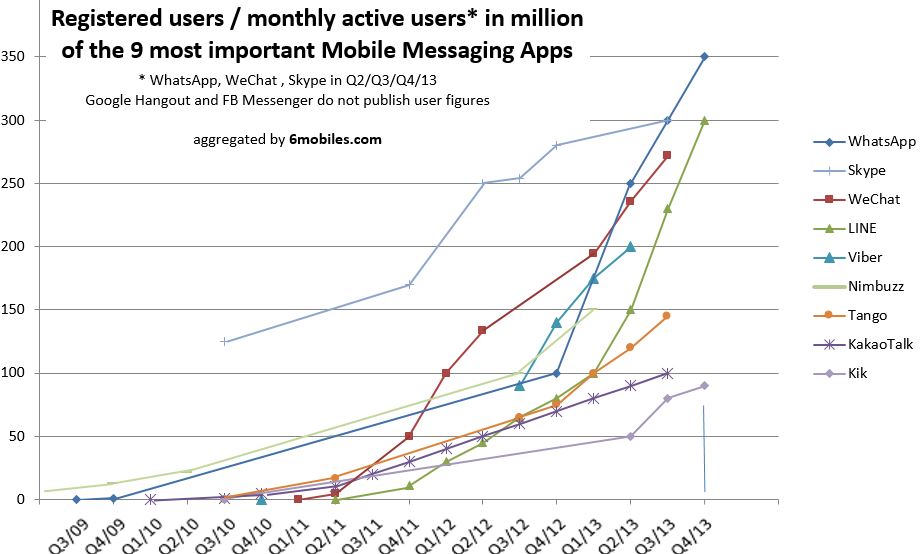

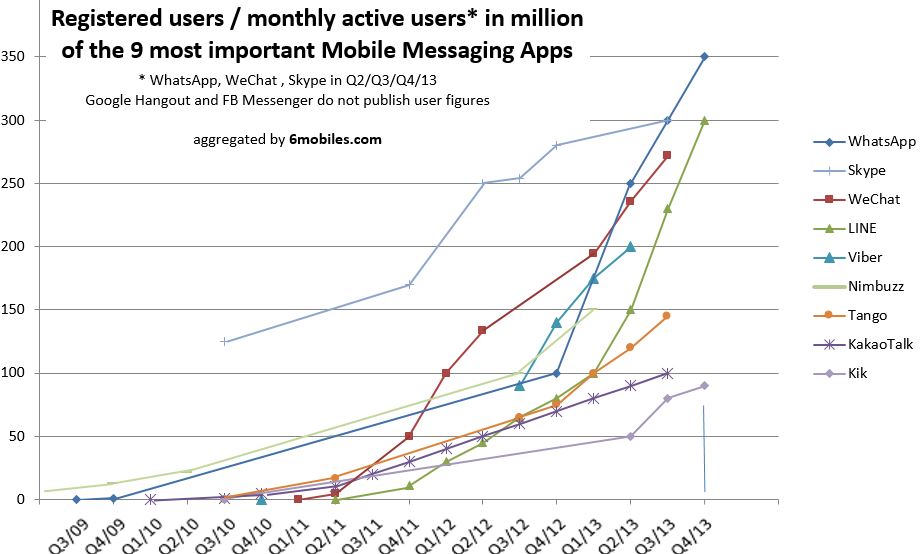

On 13th November and 25th November, WeChat resp. LINE have published their latest user numbers. WhatsApp has done that during the recent month, too. It’s a good moment to have a look at the newest comparison:

WhatsApp: 350M MAU until 22th Oct (added 25M MAU per month, in the recent months)

WeChat: 272M MAU until 30th Sep (added 12M MAU per month, in the recent months)

LINE: 300M registered users until 25th Nov (added 25M registered user per month, in the recent months)

See below the updated user base development:

The mathematical figures say that WhatsApp and LINE grow at same speed/quantities. But unfortunately LINE doesn’t report monthly active user figures. Therefore this comparison is not valid. WhatsApp is currently showing the highest growth rate in adding MAU. LINE is currently growing at nearly double speed of WeChat if assumed that 80% of LINE’s new registered users are also MAU.

These strong developments of WhatsApp and WeChat/LINE are a sign that these players will co-exist on one consumer’s mobile device because both value propositions satisfy different needs (most advanced messsaging communication interface [WhatsApp] vs. mobile social networks [WeChat/LINE]). Also see post from 17th September 2013.

Viber, Nimbuzz and Tango start to fall behind as they remain silent about their MAU figures. Kik shows good momentum as the most relevant messenger from North America in the youth segment.

WeChat most intimate

WeChat is currently the most sophisticated and intimate mobile social network for many reasons:

1) They were the first to introduce the feature people nearby (which does not exist in LINE) and the feature ‘shake-your-phone-to-find-people-who-look-for-new-contacts-too’. So the messenger is especially interesting for people who are outgoing and would like to meet like-minded people. Or if someone is new in a certain area this feature can help a lot with getting information about the place. [Nearby feature is also available on Tango or for younger people on InstaMessenger]

2) Once you have made friend with a WeChat user, you can see the time-line of this person, which can only be seen by the friends of the profile owner (A). Friends can comment on the posts (or on the profile) of (A) but these comments are only visible to the writer and (A). No other eyes! It’s a great environment to stay mobile, private and very close (verbally). It’s 1:1 communication. This is the counter-trend to postings in Facebook (1:n communication) where all is transparent to all friends (if alterable at all by special rules to be set up in the account).

3) It is more difficult in WeChat than in LINE or Kakao to enter into another person’s mobile social network environment. In WeChat most first concacts have to happen over a 40 characters greeting line. Whereas in LINE and Kakao people can paste in a high amount of greeting text to make the first contact. Therefore, connecting on WeChat is more challenging (more secure?) than in LINE and KakaoTalk, but that is probably also one of the main reasons why WeChat cannot show the same adoption speed like LINE. LINE has twice the international user base as WeChat, therefore LINE is more crowded with young people who are very open to connect internationally as they are also more likely to speak English (LINE user abroad Japan: 216M; WeChat users abroad China: 100M, both in Q3/2013). For this reason LINE has become more international than WeChat.

Still, by the facts of the home market situation, WeChat should be able to grow faster than LINE because WeChat still has huge potential in China with its more than 400M mobile internet consumers. WeChat rather spreads very strong along the immigration routes of Chinese into other countries.

Another growth slowdown factor is WeChat’s ‘dead’ communication interface without notifications of sent, delivered, read and online. Consumer research clearly shows that these indications are very important to messenger users. Read more about this in below post of 17th September.

The rise of digital Super Communicators

Messengers used in combination with Twitter have developed and inspired a new breed of young (13-25 yrs) digital Super Communicators who use virtuosically various communication channels with usually a large group of international friends and followers. Kik (and Instagram) is the most used exchange platform involved in these new connecting activities. These young Super Communicators live with the reality that they have to communication several times per day, otherwise they loose their top-of-mind-position with their followers. They become full-blown PR professionals with insights about all social tool mechanisms before 20.

A proverb of this group is: ‘When I close my Twitter on the laptop in the evening, I go to bed with my mobile and start Kik’. To some of them, this is their night entertainment: meeting new people, meeting hopefully friendly strangers.

These individuals, which are the innovators of a new soon-to-come mainstream, are also more open to the next evolution of messengers, which will connect people nearby, or connect strangers.

More analysis to follow soon.