An interesting figure has come up in the ‘religious war’ between messaging-only-strategy (WhatsApp) and messaging-plus-VAS-strategy (WeChat, LINE) to create monetary value for the mobile messaging app companies: Tech-blog The next web has recently stated that WeChat had in May 2013 more than 400 million users but only 195 million monthly active users. This means that only 50% of the people who download WeChat messaging app also use it once or more per month afterwards, which again means that 50% of the downloaders would not use the app or use it less then once a month. This is are a rather clear failure statement about the front-end success (fast increase of users) of the aggressive marketing campaigns which WeChat (and LINE) currently are executing.

On the contrary, this usage figure is not known from WhatsApp, but e.g. with a similar calculation with Germany the usage rate is at 75%. WhatsApp was a paid-for app until June 2013 in AppStore, therefore it can be assumed that the usage rate is higher in a paid app than in a free app. To be fair, it should also be mentioned that Skype had in August 2009 560 million registered users, but only 124 million monthly active users, which is a monthly usage rate of even only 22%. But this benchmark first of all proves that – with mobile adoption – the usage rate of instant messaging tools has strongly increase.

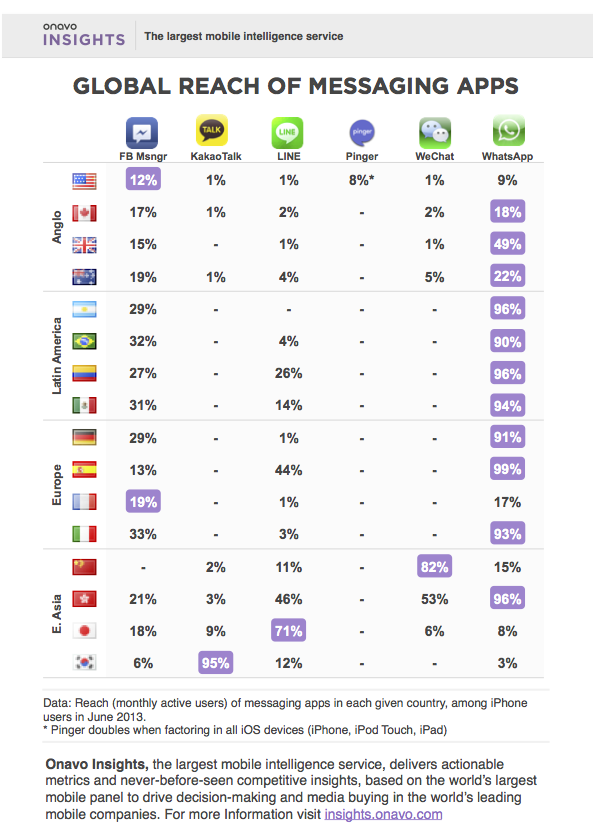

Another symbolic decade change is happening: WhatsApp was on its way to passing Microsoft in terms of search popularity according to Google Trends at the beginning of September 2013. The trend was just broken by Microsoft’s acquisition of Nokia’s mobile handset business. But the trend also shows that it is likely that WhatsApp will pass Skype in Q1/14. These are the signs of disruption by mobile solutions. In below Google Trend chart is also visible that WhatsApp is undisputed mobile messenger leader in the western world. Strong competition comes from WeChat (China) and LINE (Japan), both are not or only partly reflected in their home market by Google Trends.

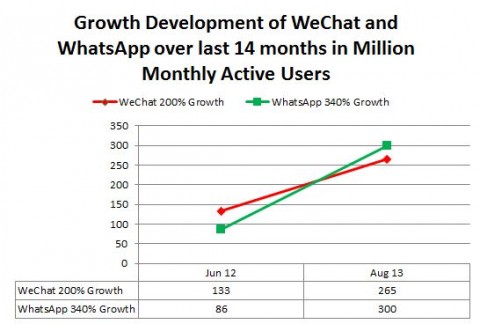

6th August 2013: WhatsApp has told AllThingsD it has 300 million monthly active users now. With an astonishing growth rate of 340% over the last 14 months (June 2012 – August 2013). This makes WhatsApp the most popular mobile messaging app outside China in the World. Only QQ NN mobile (from China) has more mobile MAU (478m MAU).

Internal calculations lead to about 90 million monthly users from Google Play (30%) (resulting from 100 million Android downloads by July 2013 and an assumed usage rate of 90%), 195 million monthly users from App Store (65%), and 15 million monthly users from other platforms like Windows and BlackBerry (5%).

Sources: WeChat Jun 12 (Tencent); WeChat Aug 13 (Tencent plus 30m MAU overseas from

The next web); WhatsApp Jun 2013 (Futurehandling.com 100m MAU ./. 14m MAU for 4 months,

assumption 6mobiles.com); Whatsapp August 2013 (AllthingD).

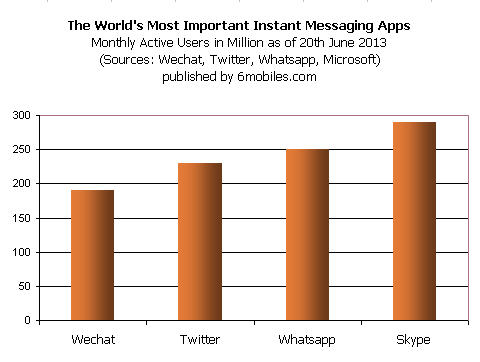

20th June 2013: WhatsApp has told The Wall Street Journal it has more than 250 million monthly active users.

20th June 2013: WhatsApp has told The Wall Street Journal it has more than 250 million monthly active users.

Most efficient

The four-year-old company WhatsApp currently employes fewer than 50 engineers, giving this disruptive company the highest ratio of active users per long-term employee today of any active tech company (6m Users per long-term employee).

User Growth

The development of WhatsApp started in February 2009, the app was eventually launched in July 2009. By end of 2009 the app had reached 1 million users. In October 2012, WhatsApp was at 100 million monthly active users. That was the first stage of early hypergrowth.

The time from October 2012 to August 2013 represents a second-stage growth period with still explosive growth of 200% within 10 months. This explosive growth was also fueled by 1) the boom effect on app distribution platforms in 2013, where the monthly app download rate in general doubled from 2012 to 2013, and by 2) the growing global smartphone penetration rate. More stats on users.

Strategy and Marketing

WhatsApp has a crystal-clear utilitarian strategy on messaging service above all, without ads or games and less emoji, provided on all possible mobile platforms (no desktop version) and in as many as possible languages, in order to guarantee optimal user experience.

WhatsApp does not advertise itself, their success is due to word of mouth. “You trust a friend more than any other source, right?” asks Brian Acton, co-founder of WhatsApp. On 12th August 2013, Kate Perry’s new music video ‘Roar’ was released; the clip is almost entirely told by WhatsApp messages. WhatsApp management says it has no endorsement deal with Kate Perry. The inspiring music video will support the global adoption of WhatsApp.

This no-marketing-strategy is in strong contrast to the strategies of WhatsApp competitors Wechat and Line. Wechat has a broad advertising campaign with Lionel Messi (Spain, Europe and South America). The ad would be aired across 15 nations soon. LINE works with special TV ads for each national market. The TV ads promise ‘Life is more fun with LINE’.

Pricing and Revenue

In the App Store, WhatsApp changed various times its pricing strategy. It started as free app in some national App stores (eg. Switzerland) and in other national app stores as paid app (eg. in the UK the app costed GBP 0.69 since December 2009). Since March 2013, the app costed $0.99 one-time fee in the App Store in all/most countries. On 16th July 2013 – only 4 months after the new pricing – WhatsApp changed the price to ‘free for the first year, but charges $0.99 per year after the first year’. This is the pricing model which WhatsApp used in Google Play ever since 2009.

In Google Play, WhatsApp only used one pricing model since its start in 2009. The app is free for the first year, but charges $0.99 per year after the first year.

The recent pricing decisions will create an annual revenue for WhatsApp in 2013 of approx. $100m from App Store and approx. $50m from Google Play. This pricing decision shows that WhatsApp wants to build up substantial long-term revenue.

The pricing itself is subtle: first the friendly offer, a consumer can use the app for free for one year which facilitates downloads of the app strongly, then after 1 year, when nobody wants to miss the app anymore, the pay scheme triggers in (as opt-in), but the annual USD 0.99 fee is low. Most of the WhatsApp users will never make any considerations about that.

Features updates for WhatsApp

On 8th August 2013, WhatsApp introduced voice messaging (walkie-talkie) to its solution, a reduced-to-the-max one tap functionality. As long as WhatsApp is not enabled for VOIP, this solution can help to facilitate the texting exchange in languages that are less simple to type (eg. Cyrillic).

On 29th Agust 2013, WhatsApp provided an APK download for the WhatsApp version 2.11.49, including some simple video editing tools. No pro tools, but it will allow users to splice and cut different videos to a certain length without having to open up a new app.

Competitors

In the new field of mobile messaging apps, Whatsapp has various rivals. The strongest competitors are Chinese originated ‘WeChat’ (with approx. 235 million MAU in August 2013, with approx. 40% (100 million MAU) of its users outside China).

WeChat (launched January 2011) users:

31th May 2011: 4-5 million registered users

31th December 2011: 50 million registered users

31th March 2012: 100 million registered users

30th June 2012: 133.4 million monthly active users

30th June 2013: 235.8 million monthly active users (70 million users outside China)

16th August 2013: 100 million users outside China

LINE (launched June 2011) users:

July 2013: 200 million registered users

14th September 2013: 240 milion registered users (stated by Dr. Jeanie Han at BeGlobal South Korea conference)

Further mobile messaging app competitors are:

Cyprus-based ‘Viber’ (approx. 220 million registered users in August 2013),

Nimbuzz (Netherland orginated, acting from India nowadays)

KakaoTalk (South Korea),

Tango (USA)

Facebook Messenger (USA)

Kik (Canada)

There is another circle of competitors: the instant messaging tools that started originally as desktop tool, but have also gained many users for their mobile app version:

QQ NN mobile (China): 478 million monthly active users

Skype with approximative 300 million monthly active users (mobile & desktop) in August 2013, but still with a high percentage of desktop only clients.

Volume of Messages

In June 2013: WhatsApp users sent 8b messages and received 12b messages (some messages go to several recipients).

In August 2013: WhatsApp users sent 11b messages and received 20b messages.

Average for June 2013: Based on 9bn – 10bn sent messages per day and about 250m active users (June 2013), in average, every active user sends about 40 messages per day.

Average for August 2013: Every active user sends about 36 messages per day.